Private Placement Transactions

private placement transactions with descriptions of Issuers, offering memorandum type including debt, convertible debt, preferred shares, deal structure from across EU, LatAm, PacRim, Middle East, North America (US, Canada, Mexico), Cayman Islands, Eastern Europe. PPM provides offering prospectus document preparation services for private and public companies via securities lawyers and corporate finance professionals fluent in offering memorandum preparation and the regulatory guidelines in each major country. Regulation A, Regulation A+, Regulation S, Regulation D, Regulation CF, 144a transactions, topics relating to Mifid 2, ISIN code and CUSIP code application, major exchange listing, equity crowdfunding initiatives and guidelines including Tier 1 and Tier 2 offerings. Preliminary Prospectus aka Red Herring vs. Financial Prospectus, best practices for mutual fund offering prospectus. Curated news stories illustrating types of private offerings placed, accredited institutional investors having interest to invest in specific industries, including green bonds, fintech, software, oil & gas, mining and disruptive products and hedge fund side-car transactions

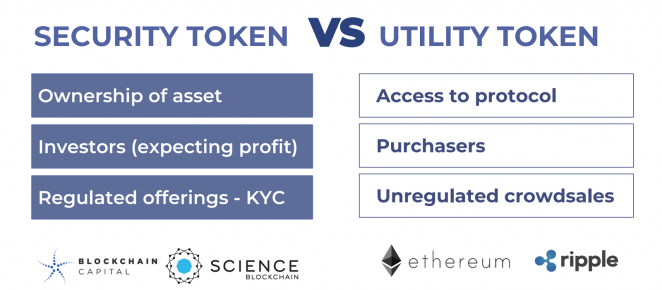

Smarter Than Funding Via ICO : STO- Securities Token Offering

April 19, 2018

Blockchain Dapps For Dummies

February 26, 2018

Breaking News: Swiss Regulator FINMA Introduces ICO Guidelines

February 16, 2018

Its All About Blockchain, You Blockhead. Not Bitcoin. Bloomberg Agrees

February 14, 2018

How Blockchain Technology Will Transform Every Business Process

January 19, 2018

ICO Regulations: Crypto Kids Need to Get Real for Bitcoin Marketplace to Morph

January 18, 2018

What’s Next? Blockchain Feasibility Study Services

January 15, 2018

Investor Pitch Deck Best Practices: Unicorn Style Presentations

January 08, 2018